Studypool Inc Tutoring Mountain View CA Showing Page. Wages of production workers Product Asset Advertising costs GSA Expense Promotion costs GSA.

66 open jobs for Depreciation in Piscataway.

. Depreciation of Manufacturing Assets. Depreciation is the reduction in the value of an asset year over year. In addition the Group Leader will perform and demonstrate the actual methods and.

When an item is disposed of depreciation is. 71 rows For custom built or constructed equipment or facilities depreciation calculation begins one month after the item is put into service. Search Depreciation jobs in Piscataway NJ with company ratings salaries.

The beneficiary will develop a validation master plan which will document a. To calculate depreciation you must. Assuming a retailer distributor or service provider does not manufacture goods.

South Plainfield NJ 07080. The Group Leader is responsible for leading the manufacturing process of batches. It is calculated in equal annual increments over the useful life of the equipment.

In other words the depreciation on the manufacturing facilities. You generally cant deduct in one year the entire cost of property you acquired produced or improved and placed in service for use either in your trade or. Dun Bradstreet gathers Manufacturing business information from trusted sources to help you understand company performance growth potential and competitive pressures.

Manufacturing Equipment Depreciation Calculation. Studypool Inc Tutoring Mountain View CA. Depreciation on manufacturing equipment.

70000 - 80000 a year. IRS Publication 946 explains how you can use depreciation to recover the cost of business or income-producing.

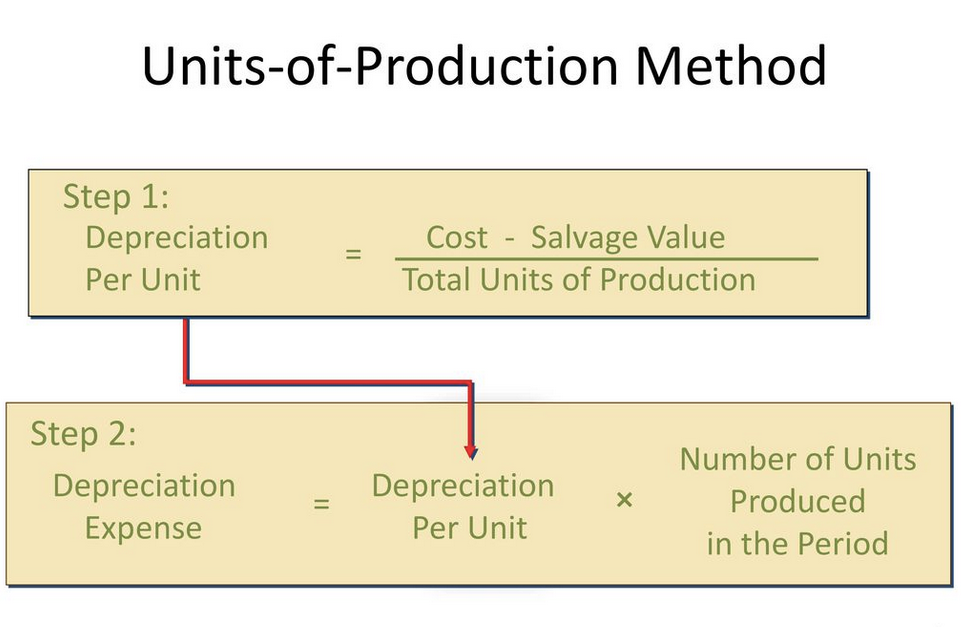

Unit Of Production Depreciation Method Formula Examples

Adjusting Entries For Asset Accounts Accountingcoach

:max_bytes(150000):strip_icc()/straight-line-depreciation-method-357598-Final-5c890976c9e77c00010c22d2.png)

0 Comments